Real estate is among the best ways to generate income as an investor in Kenya. It has been proven to be among Kenya’s most profitable investment opportunities. There are several real estate investment opportunities in Kenya that will allow you to earn long-term income while enjoying tax benefits and portfolio diversification.

Real estate investment involves the purchase, ownership, management, rental, or sale of real estate for profit. However, you should be aware of the lengthy holding time that may be required. The location of investment significantly impacts the holding duration necessary for a profitable transaction.

Here are the main real estate investment opportunities in Kenya:

- Commercial real estate

- Residential real estate

- Industrial real estate

- Real estate investment trusts (REITs)

- Renovation flips

- Buying and selling of land

- Vacation rental

1. Commercial Real Estate

This is a great plan, especially if you’re looking to invest in large projects like an office building, shopping mall, villas, and hotels. With this sort of real estate investment, you make money by renting the space to tenants. The rent and all other terms relating to the rental are agreed upon in advance.

The main advantage of commercial real estate is that it can lead to significant progress. When a commercial property is developed in a particular area, the value of that entire area rises. An excellent example is Garden City Mall and Thika Road Mall.

Owning a commercial property also has several drawbacks; it requires professional management, is capital intensive, and has numerous tedious steps such as zoning documents and securing paperwork.

Also Read: Factors to Consider When Making Investment Decisions

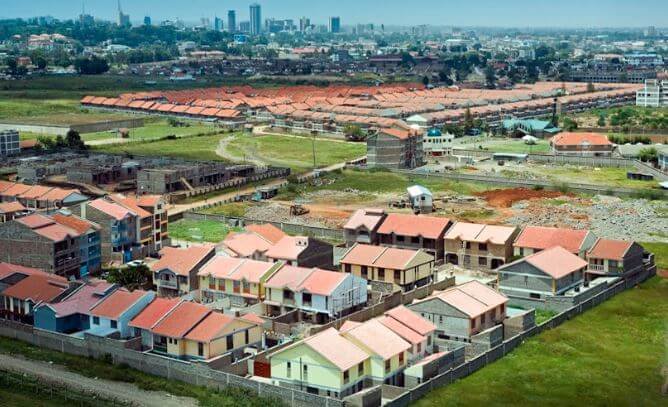

2. Residential Real Estate

This is among the most prevalent ways of earning money in real estate. Since housing is the second most crucial fundamental necessity, people will always require it; hence investing in residentials is an ideal option.

But before investing in residentials, you should consider the “location, location, and location.” This means that the value of residential properties differs considerably depending on where they are. If you’re looking to invest in a long-tenure rental, location should be at the forefront.

3. Industrial Real Estate

These properties are for manufacturing and production. It usually involves factory floors and warehouse construction. This industry sector is very potent in Kenya due to the country’s current level of manufacturing activities.

4. Real Estate Investment Trusts (REITs)

A REIT is an organization that funds income-generating real estate. REITs are exchanged on the Nairobi Stock Exchange (NSE).

REITs operate like other regular companies. They enable investors to own a share in real estate portfolios. These portfolios make money from holding real properties like office buildings, apartments, shopping malls, hotels, and apartments.

REITs manage rented properties for investors and hand over the rent earned to them. REITs invest in mortgage debt too. For instance, If a developer is building an apartment, they may apply for a loan to fund the project, and then a REIT will buy the debt from the lender.

The building owner will continue owning the property, while REIT will own the debt.

Structure of REITs

REITs can have either be:

- Open-ended or

- Close-ended structures

Depending on the situation, an open-ended fund can be converted to a close-ended fund and vice versa.

Open-Ended REITs

Open-ended is a type of REIT where shares can be issued or redeemed to investors at any time. The asset’s net value determines the redemption or investment value. The asset’s net value is then based on the asset’s total value owned by the REIT.

Then, minus the associated liabilities divided by the number of outstanding shares. Therefore the fund size may grow or shrink as investors buy or sell the securities.

Close-Ended REITs

Close-ended is a type of REIT where the amount of outstanding shares is predetermined. They generate money by selling shares to the public. Their price depends on what investors are ready to pay at any particular time. As a result, the price fluctuates due to the influence of demand and supply forces.

How To Invest in REITs in Kenya

You can buy REITs from the Nairobi Stock Exchange (NSE) through a broker. You can also purchase them through an exchange-traded fund on any other major international trading platform or through a mutual fund.

Purchasing REITs from NSE is easier, the same way you buy shares. For instance, you can visit a local broker and request to buy Stanbul Fahari I-REIT shares. If you want to buy through a mutual fund, you can put your money specifically deals with real estate.

5. Renovation Flips

This investment plan involves buying houses at a lower price and then fixing and selling them at a higher price. It mainly entails giving an existing home a makeover to make it look modern.

This strategy can be precarious and hence requires to be done by an experienced person. Each property needs its renovation budget. You’ll make your purchasing budget depending on your ability to assess and evaluate different prices associated with a particular property to ensure it’s within your allocated budget.

For instance, you can tear down the wall and find out there’s mold, a load-bearing beam that requires replacement, or outdated wiring that needs to be fixed. These unforeseen expenses may push you beyond your spending limit and reduce your return.

6. Buying and Selling of Land

Buying and selling land is a common way people generate income in Kenya. You can purchase a piece f land, subdivide it into smaller plots, and resell it at a profit.

Some people may buy it for agriculture purposes, to build their homes, or hold it to sell at a profit in the future.

7. Vacation Rental

Vacation rental yields significant profits though short-term. These rentals serve as safe havens for those who can afford them. Locations with numerous tourist attractions are ideal for investing in vacation rentals such locations in Kenya are:

- Mombasa

- Nanyuki

- Nairobi

- Nakuru

Investing in an apartment in the affluent Kileleshwa, Kilimani, and Westland locations could be a feasible strategy for the profitable Airbnb business.

Is Real Estate Investment in Kenya Worth a Try

Real estate in Kenya is thought to be an ideal investment option. It outperforms mutual funds, bonds, and stocks. It’s a long tenure investment that generates instinctive income as the property’s value appreciates over time. It’s also an ideal strategy to build your wealth in the future.

Maybe you’ve been advised that investing in real estate is a good starting point, but you fear losing your money. Here are the reasons why you should consider real estate investment

Why Invest in Real Estate

Real Estate is Improvable

Real estate is a tangible asset made of concrete, blocks, and glass. The substance has remarkable and noticeable qualities meaning they are improvable. Whether structural or aesthetic, you can undertake the repairs yourself or hire a professional.

It Has Foreseeable Cash Flow

In Kenya, well-constructed real estate ought to generate a cash flow of 6% or more. And this should be after all the mortgage expenses and operating costs have been made.

Whether commercial or residential, you’re guaranteed monthly or annual income when you lease your space.

Unlike real estate investment, it’s hard to when you see money coming back into your account with other investments such as shares and stocks. In real estate investment, you can predict when and how much money will flow into your account monthly and annually.

Real Estate Appreciates Value

Real estate is among the best investment as it appreciates with time. When investing your money in any kind of real estate, you’re putting it down and allowing it to grow in the future.

The National Association of Realtors estimated a 6% annual increase in value level despite a declining economy as of 2007. However, you should invest in the appropriate real estate to see those significant profits.

With the proper planning, you can never go wrong with real estate investment. In the long run, you’ll benefit from Return on Investment (ROI) and appreciate your property’s value.

Inflation Hedging

Real estate’s inflation hedging potential results from the positive correlation between real estate demand and GDP growth. As the economies grow, rents rise in response to increasing real estate demand, which raises capital values.

Investing in real estate can therefore provide you with a rising monthly income protecting you when the prices of everything hike too.

High Tangible Asset Value

Tangible projects are always more attractive than intangible ones. For example, if you buy shares and stocks in a particular company, no one will see the stock certificates, if there are any. The company just gives a license to trade stocks with them.

Unlike stocks and, to some extent, bonds, an investment in real estate is supported by a higher level of mortar and brick. Hence reduces the principal-agent conflict or the extent to which the investor’s interest depends on the honesty and competency of management and borrowers.

Even real estate investment trusts, listed real estate securities, usually have restrictions that require a minimum percentage of profits to be paid out as dividends.

Bottom Line

Real estate investment is among the few businesses with high returns in Kenya. There are also various ways of generating income through real estate. And there you have them, the real estate investment opportunities in Kenya and why you should consider investing in real estate.

The secret is to start small and advance gradually.