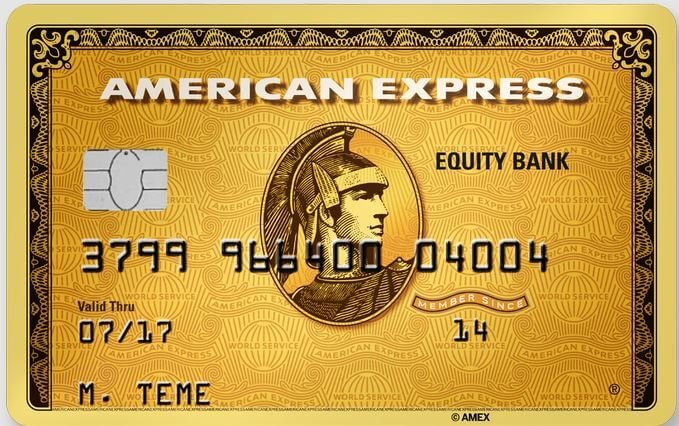

Equity Gold Credit Card by Equity Bank Kenya Limited is ideal for high-income earners. It is a secure bank card featuring a chip and PIN. You might qualify for the Equity Gold Credit Card if you have a high income and an account with Equity Bank. Read this guide to understand how to get Equity Gold Credit Card easily.

Features of Equity Gold Credit Card

Equity Gold is a high-quality credit card with the following features:

- PIN: The PIN increases your security when transacting with the card. It verifies the data in the chip.

- Chip: The chip stores your unique personal details safely. It will make this data available to the PIN every time you transact with your credit card.

- Universally accepted: Equity Gold credit card is a global Visa card. You can use it to withdraw cash from any Visa-branded ATM.

- No transaction fees: You can use your credit card to purchase goods or services at any merchant outlet without incurring transaction fees.

- ATM Withdrawals: The Equity Gold Credit Card can perform ATM withdrawals where you see the VISA logo.

- Instant Notifications: Equity will generate an SMS notification after you transact with your card.

- Flexible Repayment Period and Interest Rate: This Equity Bank card operates on a revolving credit, giving you a forty-five-day interest-free period. Additionally, you can repay your outstanding monthly balance at a fee of 20%.

- Monthly Statements: Cardholders can get monthly statements showing every transaction and the date it occurred.

- Life Insurance: The Equity Gold Credit Card protects your family and you.

Find Out: How To Get Equiloan From Equity Bank Easily: The Ultimate Guide

Requirements to get Equity Gold Credit Card

The necessary Gold Card registration requirements include:

- Have an already approved credit limit.

- Come with your KRA PIN Certificate.

- Bring your Kenyan national ID card or passport.

People with existing Equity Bank accounts and a credit limit can apply for the Gold Credit Card. Alternatively, Equity Bank customers who can offer a cash cover as collateral can get this card.

If you are an Equity customer who requires a credit card for business, travel, leisure, etc, talk to a bank official. They will explain the Terms and Conditions of this product when filling out an account opening form.

How to Apply for an Equity Gold Credit Card

First, ensure you meet the registration requirements. Also, note that Equity Bank might not approve your card application if your name is on CRB. If you ever want this card, clear your name from CRB before contacting the bank.

If you are ready, here is how to get Equity Gold Credit Card easily:

- Visit any Equity Bank Kenya branch near you. Alternatively, visit the bank’s website and download an application form.

- Fill all the empty spaces on the application form. Proofread your form to ensure all the information is true and accurate.

- Submit the form to the bank officer and wait for the verification process to end.

- Collect your Gold Credit Card from the same Equity Bank branch you applied it in. That is if the bank accepted your application.

- Start using the credit card.

Find Out: How To Deposit Money From M-Pesa To Equity Bank

Advantages of Gold Credit Card From Equity Bank

Once you learn how to get Equity Gold Credit Card easily and apply for it, you will get the following benefits:

- The Gold Credit Card can be helpful during an emergency.

- You can purchase expensive air tickets and similar items with it.

- This credit card allows you to travel anywhere without carrying cash.

- With the Gold Credit Card, you get a solution for corporate expenditures.

- It is safer to purchase expensive things with your Gold Credit Card, as it is more portable than cash.

- You can borrow up to a certain monthly limit. This can prevent you from creating huge debts.

- Equity Bank allows you to pay flexibly. First, you can pay your outstanding credit card debt at once or in manageable installments.

- Some merchant outlets affiliated with the bank will give you occasional discounts due to shopping with your credit card.

Handling Your Equity Gold Credit Card

You will be prone to certain risks if you get an Equity Gold Credit Card or any credit card. So, handle your card this way:

- Never show your PIN to any person.

- Change your PIN at the ATM location if someone has cracked it.

- Do not give away the most sensitive details of your credit card. These include the card’s expiry date, card number, and the verification value at the back.

- Ask Equity Bank to block your Gold Credit Card soon after misplacing it. Alternatively, block your card directly on the Equity App.

This tariff guide shows the Gold Credit Card charges you will be paying.